If you’re searching for the best accidental insurance plan for family 2025, the Pradhan Mantri Suraksha Bima Yojana (PMSBY) stands out as one of the most affordable and effective options in India. Launched by the Ministry of Finance, this government-backed scheme is designed to provide accidental death and disability coverage to millions of Indian citizens, especially those with low income.

In this article, we’ll explore why PMSBY is considered the best accidental insurance for individuals and families in 2025.

What is Pradhan Mantri Suraksha Bima Yojana (PMSBY)?

The Pradhan Mantri Suraksha Bima Yojana is an accidental insurance scheme that provides financial support in case of accidental death or disability. It is specially designed for Indian citizens who hold a savings bank account.

Key Highlights:

- Annual Premium: ₹20 only

- Coverage Period: 1st June to 31st May (renewable every year)

- Coverage Amount:

- ₹2 Lakhs for death or total permanent disability

- ₹1 Lakh for partial permanent disability

This scheme is ideal for families looking for the best accidental insurance plan for family under a budget.

Eligibility Criteria

To enroll in PMSBY, the following criteria must be met:

- The applicant must be between 18 and 70 years of age

- Must have a savings account in a participating bank

- Must provide consent for auto-debit of premium from the bank account

Whether you live in a rural or urban area, this is one of the best accidental insurance plans for safeguarding your family’s future.

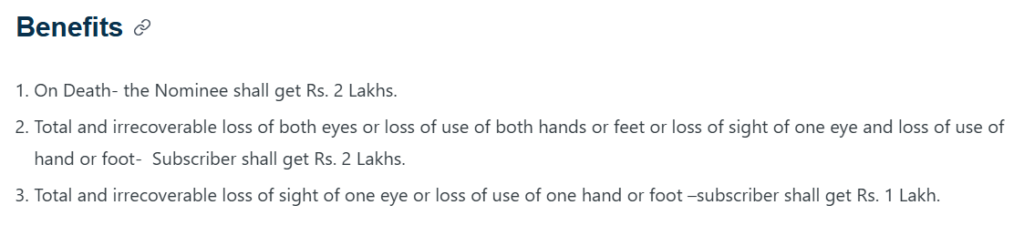

Benefits of PMSBY – Why It’s the Best Accidental Insurance in 2025

This government scheme offers clear and impactful benefits at a minimal cost:

| Condition | Insurance Benefit |

|---|---|

| Accidental Death | ₹2,00,000 to nominee |

| Total and Irrecoverable Loss (both eyes, both limbs, or one eye + one limb) | ₹2,00,000 |

| Partial Loss (one eye or one limb) | ₹1,00,000 |

For families, this means peace of mind knowing that your loved ones are financially protected after unforeseen events.

How to Apply for PMSBY

Enrolling in PMSBY is a simple process, available both offline and online.

Offline Process:

- Visit your bank branch where you hold a savings account.

- Fill out the PMSBY application form (available at: https://jansuraksha.gov.in/Forms-PMSBY.aspx).

- Submit the form along with basic documents.

- Receive your Certificate of Insurance.

Online Process:

Many banks provide the PMSBY enrollment option via net banking or mobile apps. Just log in and navigate to the insurance or government schemes section.

When Does PMSBY Coverage End?

Coverage under PMSBY may terminate if:

- You turn 70 years old

- You close your bank account

- You have insufficient balance for the annual premium

- You enroll from multiple bank accounts (insurance will be restricted to ₹2 lakhs only)

Required Documents

- Bank account number with auto-debit consent

- Age proof (if needed)

- Properly filled application form

Contact & Support

- National Toll-Free Numbers: 1800-180-1111 / 1800-110-001

- State-wise Support: Download State-wise Toll-Free Numbers (PDF)

Frequently Asked Questions (FAQs)

Q1. Who can claim the benefit after the death of the insured person?

The nominee mentioned in the form will receive the claim amount.

Q2. What happens in case of suicide?

Suicide is not covered under the PMSBY policy.

Q3. Is FIR required for claim approval?

Yes, police verification is generally needed in case of accidents.

Q4. Can I enroll from multiple banks?

Yes, but the insurance benefit will be restricted to ₹2 lakhs only.

Q5. Is this plan open to NRIs?

No, only Indian residents with valid bank accounts are eligible.

Why Choose PMSBY as the Best Accidental Insurance Plan for Family?

- Lowest premium in India

- Government-backed and trustworthy

- Available across all banks and post offices

- Covers a wide range of accidental disabilities

- Ideal for low- and middle-income families

If you’re planning to secure your family’s future in 2025, PMSBY is easily one of the best accidental insurance plans for family that offers financial stability in critical times.

Final Words

When it comes to affordability, ease of access, and nationwide coverage, PMSBY stands out as the best accidental insurance plan for family in 2025. At just ₹20 per year, it offers invaluable protection to your loved ones.

Start today — secure your family’s future with PMSBY.