India’s Biggest Secret to Starting a Small Business — Revealed

I’ll be honest with you—when I first heard that over 3769 government schemes exist in India, I was stunned. But what shocked me even more is that most people don’t even know which schemes are for them. And one such powerful yet ignored scheme is the Pradhan Mantri Mudra Yojana (PMMY).

So if you’ve ever thought of starting your own business or expanding a small shop, this post might be the turning point for you.

Because what I’m about to explain could give you access to up to ₹20 lakh in funding — without needing any collateral or big contacts.

Let’s break this down simply, truthfully, and in a way that actually helps you take action.

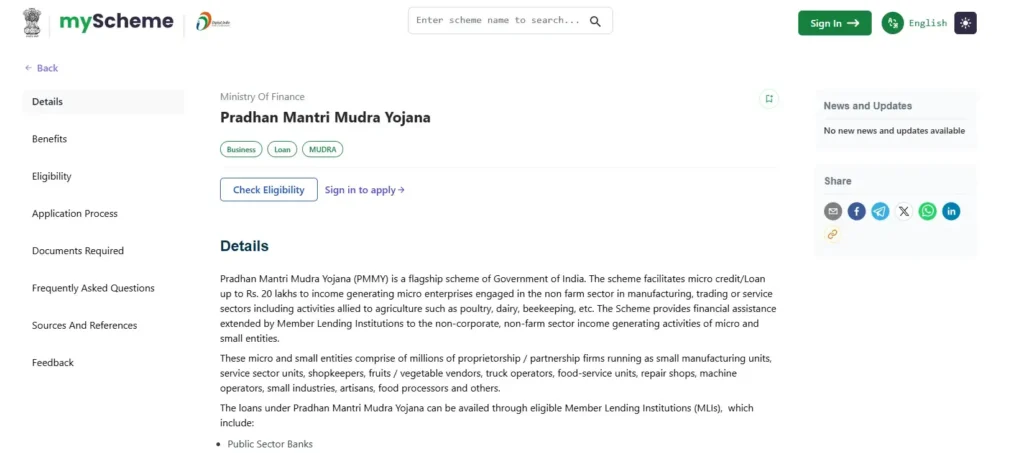

Why PMMY Exists: A Loan Designed for Real People Like Us

In India, crores of people run small shops, tea stalls, tailoring units, mobile repair centers, garages, beauty parlors, or farms. But do they get easy access to bank loans?

No.

They’re either rejected or forced to borrow from moneylenders at crazy interest rates.

That’s why in April 2015, the Government of India launched the Pradhan Mantri Mudra Yojana (PMMY) under the MUDRA Bank initiative — to give micro-entrepreneurs what they need most: faith and finance.

This scheme helps people like you and me get loans without any guarantee for starting or growing a business.

Who Is This Scheme For?

If you’ve ever thought:

- “I want to start something of my own, but I don’t have capital.”

- “I want to expand my shop but the bank asks for security.”

- “I need just ₹50,000 or ₹2 lakh to buy machines or material.”

…then this scheme is exactly for you.

Under PMMY, anyone engaged in non-farm income-generating activities — like manufacturing, trading, services, or allied agriculture (like poultry, dairy, etc.) — can apply.

Even if you are:

- A small vendor or shopkeeper

- A woman wanting to start a home business

- A youth with a skill or plan

- A first-time borrower

You are eligible. No high qualifications. No complex demands.

Types of Mudra Loans – Pick What Fits You Best

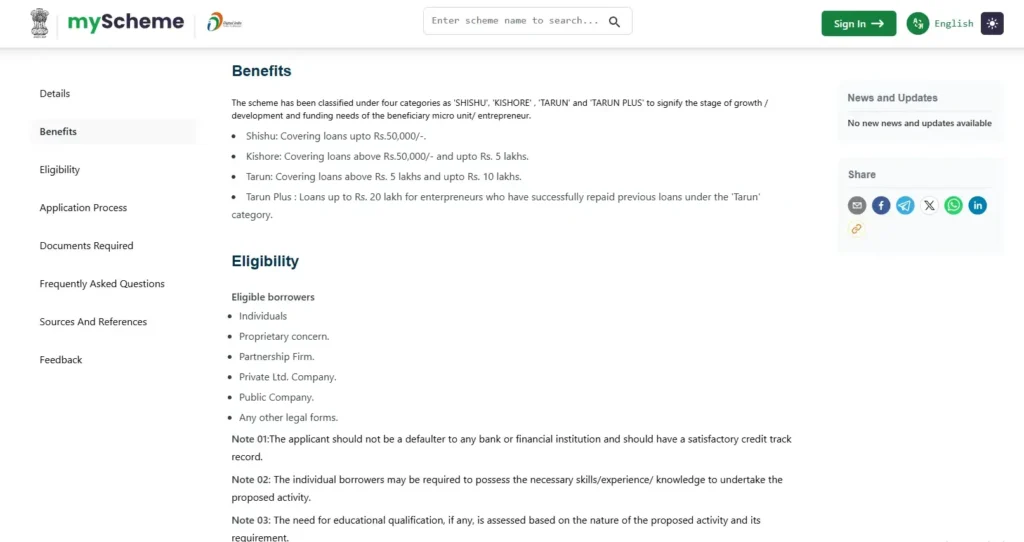

PMMY offers loans under 3 categories, depending on how much you need and for what stage of business you’re in:

- Shishu Loan (up to ₹50,000):

For those just starting out. Perfect for vendors, cart owners, hawkers, home-based work. - Kishor Loan (₹50,001 to ₹5 lakh):

For those wanting to grow – maybe buy machines, take a shop on rent, invest in raw materials. - Tarun Loan (₹5 lakh to ₹10 lakh):

For well-established small units looking to expand further, add inventory, or scale up operations.

⚠️ Important: Some banks now also offer Tarun Plus loans up to ₹20 lakh to repeat borrowers with good repayment history.

If you want to check in detail you can visit My Scheme Official Government Website – myscheme.gov.in

What Are the Benefits That Make This Scheme So Powerful?

Let me highlight why this is not like any ordinary bank loan:

- ✅ No Collateral Needed (up to ₹10 lakh)

- ✅ Subsidized Interest Rates based on RBI guidelines

- ✅ No Middlemen – direct bank connection

- ✅ Minimal Documentation

- ✅ Loan for Any Business Activity – not restricted to one sector

- ✅ Opportunity for Women & Youth – preference is often given to women entrepreneurs

This isn’t just a loan; this is a launchpad.

Also Read: How to Find Best Government Scheme for Yourself or Your Family (Step-by-Step 2025 Guide)

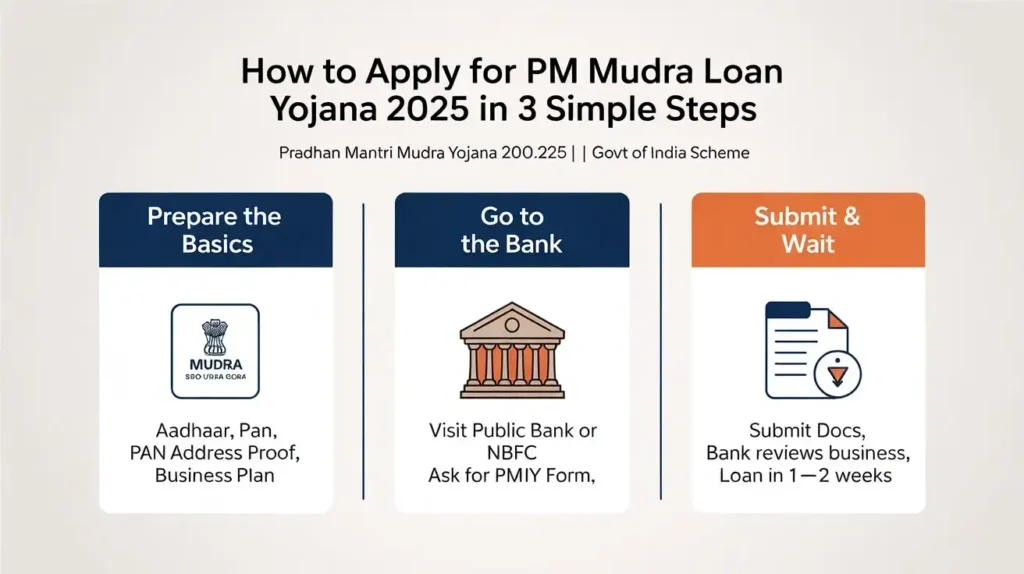

How to Apply – A Step-by-Step Guide (Simple & Real)

You don’t need an agent or someone “inside the bank.” Here’s what you actually need to do:

Step 1: Prepare the Basics

- Your Aadhaar Card

- PAN Card

- Address Proof

- Passport-sized photos

- Business Plan or Activity Plan (even a 1–2 page description is fine)

Step 2: Go to the Bank

Visit your nearest Public Sector Bank, Regional Rural Bank, Cooperative Bank, or select NBFCs that support PMMY.

Ask for a PMMY Application Form (you can also download it online from bank websites).

Step 3: Submit & Wait

Give your filled form, documents, and business plan.

The bank will evaluate:

- Your idea or current business

- Ability to repay

- Your past loan history (if any)

Once approved, your loan is disbursed, often within 1–2 weeks.

What’s the Catch?

I know what you’re thinking — “Is it really that simple?”

Yes. But only if:

- You present a genuine business plan (even handwritten is fine if clear)

- You have no major loan defaults

- You actually intend to use the loan properly

If you’re honest and prepared, you stand a high chance.

Real Stories – Real Impact

Let me tell you one example that deeply moved me:

A woman from Jharkhand started a tailoring business with a ₹50,000 Shishu loan. Today, she employs 3 other women and has applied for a ₹3 lakh Kishor loan to expand.

Another boy in Uttar Pradesh used the loan to open a mobile repair shop after learning the skill online. He now earns more than ₹30,000 per month.

These are not actors or poster-people. They are citizens who just needed a little trust.

Frequently Asked Questions

1. Can I apply without a business already running?

Yes, if you have a solid plan, banks do support new businesses under Shishu or Kishor category.

2. What is the interest rate?

Depends on the bank and your category, but usually between 8.5% to 12% per annum.

3. Is subsidy provided?

PMMY itself does not offer a subsidy, but you may get linked benefits under schemes like Stand-Up India, Startup India, or State Subsidies.

4. Can I apply online?

Mostly it’s an offline process, but some banks now allow initial online applications. Check your bank’s website.

Tips to Get Approved Faster

- Keep your CIBIL or credit score clean.

- Write a short but clear business plan.

- Attach bill estimates if you’re buying equipment or goods.

- Follow up with the bank manager professionally after 5–7 days of submission.

Final Words – Don’t Just Read, Act

I’ve written this not just to inform you, but to encourage you.

If you’ve been sitting on a business idea… or struggling with capital… or waiting for “the right time” — this is your chance.

The Pradhan Mantri Mudra Yojana is real. It has already helped crores of Indians.

Why not you next?

Let this blog not just be something you read and forget. Bookmark it, share it, take action. And if you’re confused anywhere, feel free to reach out or comment.

A business of your own is possible — and PMMY is one strong step toward it.